People may tell you, “You have your whole life ahead of you.” While this may seem true in your 20s, don’t let that thought fool you into thinking you do not need to start saving for retirement until later. Now is the time to start thinking about retirement and how you’re going to save. It’s simple: if you start saving now, even just a little, you’re going to have more money in the future. You may have student debt, car loans, and rent to pay for, but even if you can save a little bit every month, you’ll thank yourself in the long run.

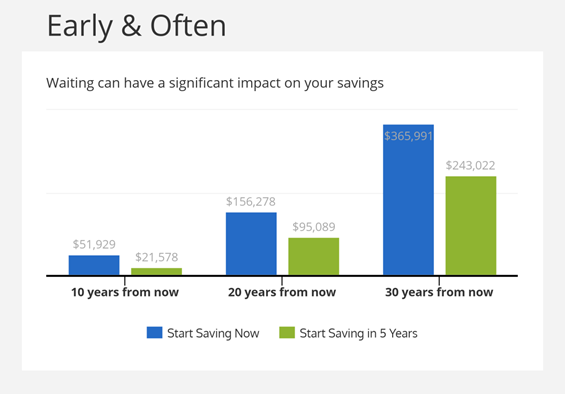

Even just over ten years, you can save over double the amount if you start saving immediately rather than waiting five years from now to start saving:

This illustration assumes a salary of $75,000, pre-tax contribution rates of 6, 8 and 10%, with those contributions made at the beginning of the month and a 6% annual effective rate of return. This chart is hypothetical and for illustrative purposes only. It is not intended to represent the performance of any specific investment. Actual returns will vary and principal value will fluctuate. Taxes are due when money is withdrawn.

This illustration assumes a salary of $75,000, pre-tax contribution rates of 6, 8 and 10%, with those contributions made at the beginning of the month and a 6% annual effective rate of return. This chart is hypothetical and for illustrative purposes only. It is not intended to represent the performance of any specific investment. Actual returns will vary and principal value will fluctuate. Taxes are due when money is withdrawn.

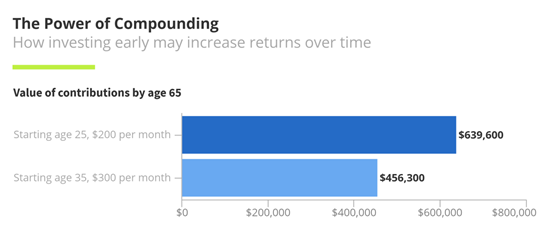

Say you wait until you are 35 to start saving, because by then you’ll have a steady job and a bigger paycheck. You are able to take more out of your paycheck now than you would have ten years ago so it should be no big deal and you’ll save about the same amount, right? Not necessarily. As the graph below shows, if you start saving $200 at the age of 25, with compounding, you will have almost $200,000 more than if you started saving $300 at the age of 30 in a compounding account.

This chart is hypothetical and for illustrative purposes only. It is not intended to represent the performance of any specific investment. Actual returns will vary and principal value will fluctuate. Taxes are due when money is withdrawn. This illustration assumes your ability to continue to make contributions of $300 on a monthly basis. Assumes a hypothetical 7% annual return compounded monthly and no distributions.

This chart is hypothetical and for illustrative purposes only. It is not intended to represent the performance of any specific investment. Actual returns will vary and principal value will fluctuate. Taxes are due when money is withdrawn. This illustration assumes your ability to continue to make contributions of $300 on a monthly basis. Assumes a hypothetical 7% annual return compounded monthly and no distributions.

Time is your friend. You are always going to have some sort of expense at each stage in your life: college, rent, and car payments early on; house, kids, and potential needed time off as you get older; paying for kids in college, taking care of your elderly parents and your aging self as you are nearing retirement. There will always be an excuse, but time runs out, and you need to take care of yourself for the future.

Think about the following questions:

When do you expect to retire?

How long do you expect to live in retirement?

What kind of lifestyle do you want to live in retirement? (Do you want to travel? Do you want to spend your extra time with your friends and family?)

Now, do you think you will be able to afford to retire if you wait? According to the National Center for Health Statistics, we can expect to live about 19 more years after we retire at the age of 65. Social Security only provides a small amount of income, not enough to live off of during retirement. Don’t cheat yourself out of the life you want to live by thinking you have more time to save than you actually do.

We’re here to help! Contact Sentinel Benefits & Financial Group for the guidance you need.