Contributions to your Health Savings Account (HSA) is a great way to set funds aside for current medical expenses while also saving for expenses in the future. An HSA allows you to make contributions to help grow your savings, and if used for eligible health care expenses, do so tax-free.

If your employer sponsors your HSA plan, you may be able to set up payroll deferrals to contribute to your HSA plan automatically. If not, or you want to submit additional contributions outside of payroll.

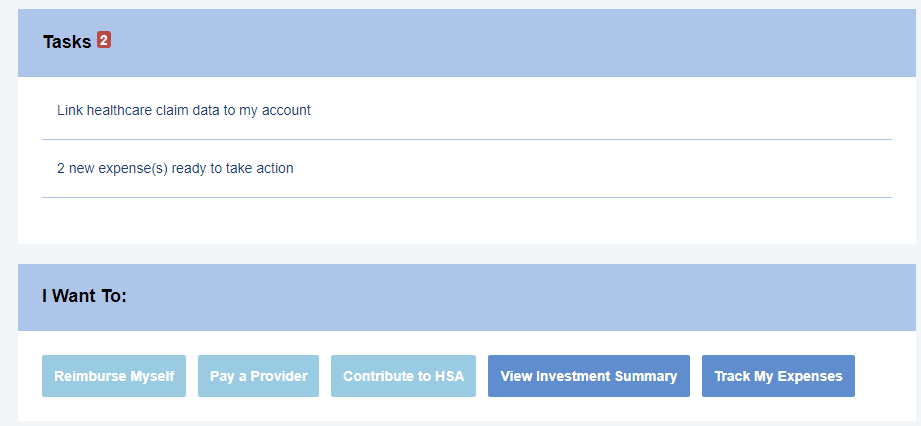

Make contributions in just a few easy steps through your online account.

1. Log into your online account and go to the Accounts menu.

2. Select Make an Contribute to HSA from the I Want To menu

3. Create Transaction: In the From section select your bank that you would like the funds to come from. **Please Note** You will need to update your banking information in your profile prior to creating the transaction or the bank account will not be available.

4. You can do a one-time deposit or set up scheduled deposits from your bank. Select the frequency and click Next.

5. Enter amount of transaction (either one-time or scheduled) and click Next. Confirm the changes and click Submit.

*Note - there are contribution limits to your HSA. For 2026 the limits are:

| Plan Type | Plan Limit |

| HSA Individual Contribution | $4,400 |

| HSA Family Contribution | $8,750 |

You may also submit contributions by check. To send a check you will need to also complete the HSA Contribution Request.pdf. Form.

When we receive funds outside of payroll deductions over $1,000 there is a 4 to 5 day system hold before the funds can be spent.

Completing the Contribution Form

Complete all sections of the form including:

- Personal Information

- Tax Year Contribution should be applied to (contributions will be credited to current tax year unless noted on the form. Prior year contributions must be postmarked by the Federal tax return deadline).

- Amount of contribution

- Signature

Make check payable to Sentinel Benefits & Financial Group and mail to:

Sentinel Benefits Group 100 Quannapowitt Parkway, Suite 402 Wakefield, MA 01880

Email signed form to: HSA@sentinelgroup.com

Be sure you have Set Up Investments to be sure any funds above your cash threshold are invested according to your selections.